TL;DR Summary

- DeFi (Decentralized Finance) is a blockchain-based financial system that removes intermediaries, allowing users to trade, lend, borrow, and earn passive income through smart contracts.

- Unlike traditional finance, DeFi is open 24/7, permissionless, and gives users full control over their funds.

- Before diving in, understand key risks (hacks, smart contract vulnerabilities, impermanent loss) and start small.

Table of Contents

1. Introduction to DeFi

Traditional finance is like an old, creaky machine—slow, cumbersome, and full of gatekeepers. Decentralized Finance (DeFi) is the sleek, new model, cutting out the middlemen and putting you in the driver’s seat.

DeFi is a financial system built on blockchain technology that replaces traditional intermediaries (like banks) with smart contracts—self-executing code that automates financial transactions. Think of it this way: traditional finance is like a gated community where only a select few have access. DeFi opens the gates, creating an open marketplace where anyone can participate without asking for permission.

1.1 A Brief History & Evolution of DeFi

While the concept of decentralized digital money began with Bitcoin in 2009, the true foundation for DeFi was laid when Ethereum launched in 2015. Ethereum’s smart contract functionality made it possible to build entire financial applications that run autonomously on the blockchain.

- 2015–2017: The Early Experiments

- Ethereum introduced programmable contracts, allowing developers to experiment with decentralized applications (dApps).

- MakerDAO emerged in 2017, pioneering decentralized lending and stablecoins (DAI).

- 2018–2019: Growing Pains

- Projects like Compound and Uniswap launched, establishing lending protocols and automated market makers (AMMs).

- The term “DeFi” (short for decentralized finance) started gaining traction.

- 2020: “DeFi Summer”

- Yield farming exploded in popularity, with users earning high APYs by providing liquidity to DeFi protocols.

- The Total Value Locked (TVL) in DeFi soared from under $1 billion to several billion within months.

- 2021–2022: Mainstream Awareness & Challenges

- Institutional players and major exchanges began integrating DeFi concepts.

- Market volatility and high gas fees on Ethereum spurred development of Layer 2 solutions (e.g., Arbitrum, Optimism).

- Several high-profile hacks underscored the importance of smart contract security.

- 2023 & Beyond: Toward a Multi-Chain Future

- As TVL continues to expand across various blockchains (Ethereum, Binance Smart Chain, Polygon, etc.), DeFi is evolving into an interconnected, multi-chain ecosystem.

- Regulatory scrutiny is increasing, pushing the space toward more robust legal frameworks and compliance solutions.

Why This Matters: DeFi’s rapid evolution has broken down barriers to financial services, enabling anyone with an internet connection to trade, lend, borrow, and earn yield—without relying on big banks or traditional intermediaries. As the ecosystem matures, it continues to push the boundaries of what’s possible in global finance.

1.2 How Smart Contracts Power DeFi

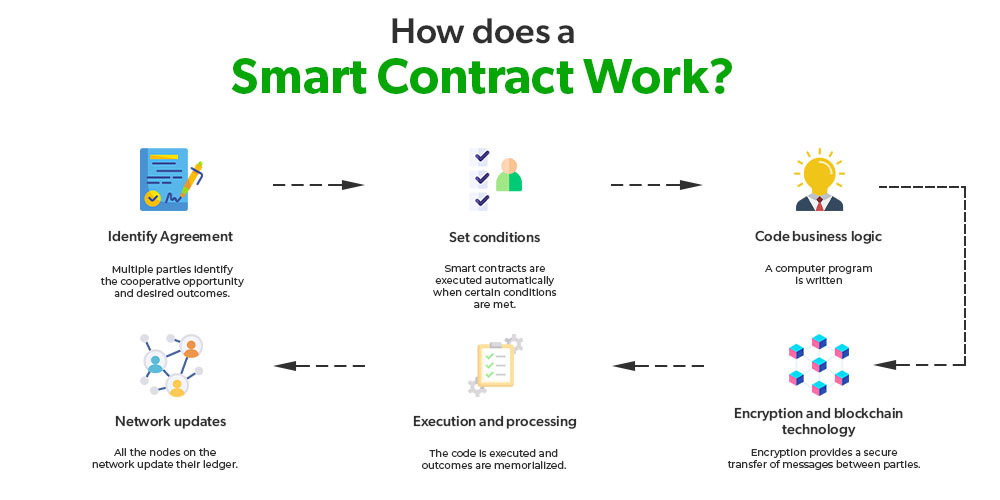

At the heart of DeFi are smart contracts—self-executing programs that are stored on Blockchain and automatically enforce financial agreements when predefined conditions are met. They are the digital versions of the standard paper contract, whose terms of the agreement are written in the lines of code.

They automatically execute transactions if certain conditions are met without requiring the help of a third party to manage or approve the transaction. This third party could be a government organization, a lawyer, or any other entity. For instance, in traditional paper contracts, a document outlines the terms of conditions between two parties, which is enforceable by law.

If one party A violates the terms, party B can take Party A to court for not complying with the agreement. Whereas, in the smart contract, such agreements are written in code, so the conditions of the agreement are automatically enforced without any third party getting involved.

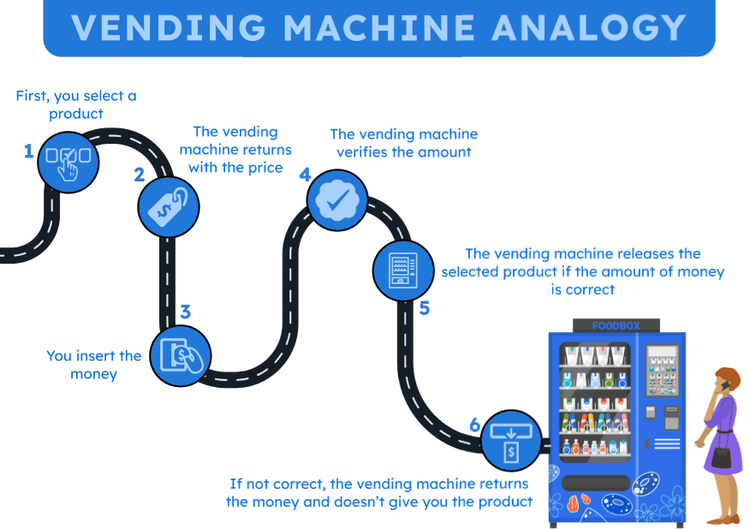

Imagine a vending machine: you insert money, select a product, and it dispenses your item without needing a cashier. Similarly, smart contracts execute transactions when predefined conditions are met, eliminating the need for intermediaries.

Decentralized & Trustless

Smart contracts remove the need for banks, brokers, or lawyers to oversee transactions. The code itself enforces the rules.

Immutable & Transparent

Once deployed, these contracts can’t be altered without consensus, and all transactions are visible on the public ledger.

Example: Lending on Aave

- You deposit 1 ETH into Aave’s lending pool.

- The smart contract automatically lends it to borrowers who put up collateral.

- You earn interest without any bank approving or denying the transaction.

Key Takeaway: By cutting out middlemen, smart contracts offer faster, cheaper, and more inclusive financial services—all governed by open-source code rather than corporate or governmental gatekeepers.

With this expanded foundation, you now have both the “big picture” history of DeFi and a clear understanding of how smart contracts power its core operations. Next, we’ll dive deeper into the mechanics of DeFi and explore how it differs from traditional finance in practice.

2. Glossary of Key DeFi Terms

Why a Glossary?

DeFi introduces a host of new concepts and jargon that can be overwhelming. Use this glossary as a quick reference to clarify important terms as you explore decentralized finance.

2.1 Common DeFi Terms & Definitions

- TVL (Total Value Locked)

- Definition: The total amount of crypto assets deposited in a DeFi protocol (e.g., lending pools, liquidity pools).

- Why It Matters: TVL is often used as an indicator of a platform’s popularity and trustworthiness.

- Liquidity Pool (LP)

- Definition: A pool of tokens locked in a smart contract, used by decentralized exchanges (DEXs) to facilitate trading without traditional order books.

- Why It Matters: Liquidity pools enable instant, permissionless token swaps and are central to yield farming strategies.

- LP Tokens

- Definition: Tokens you receive when you deposit assets into a liquidity pool. They represent your share of that pool.

- Why It Matters: You can often stake or lend these LP tokens elsewhere to earn additional rewards (a strategy called “farming”).

- Impermanent Loss

- Definition: The temporary loss in value you experience when the price of tokens in a liquidity pool changes compared to simply holding them.

- Why It Matters: Key risk in yield farming; understanding it is crucial before providing liquidity to volatile token pairs.

- Gas Fees

- Definition: Transaction fees paid to miners or validators for processing transactions on a blockchain (most notably Ethereum).

- Why It Matters: High gas fees can eat into profits, especially on Ethereum. This is why many users turn to Layer 2 solutions or alternative chains.

- APY vs. APR

- Definition:

- APR (Annual Percentage Rate): The yearly interest rate without compounding.

- APY (Annual Percentage Yield): The yearly interest rate with compounding.

- Why It Matters: DeFi protocols often quote APYs, which can be higher than APRs due to reinvested rewards.

- Definition:

- Flash Loans

- Definition: Unsecured loans that must be borrowed and repaid within a single blockchain transaction.

- Why It Matters: Flash loans enable complex arbitrage and liquidation strategies but can be exploited if the protocol isn’t secure.

- DAO (Decentralized Autonomous Organization)

- Definition: A community-led organization governed by smart contracts and token-based voting.

- Why It Matters: DAOs remove hierarchical management structures, giving token holders direct control over project decisions.

- Rug Pull

- Definition: A scam where a project’s developers abruptly abandon it and run off with user funds.

- Why It Matters: One of the biggest risks in DeFi; always research a project’s credibility and security audits.

- Oracle

- Definition: A data service that feeds off-chain information (like asset prices) into a blockchain.

- Why It Matters: Oracles are critical for DeFi protocols to function accurately—any manipulation can lead to exploit.

2.2 How to Use This Glossary

- Bookmark It: As you read through the rest of this guide, refer back here whenever you encounter unfamiliar terms.

- Stay Curious: The DeFi space evolves quickly, so keep an eye out for new terms and innovations.

With these core definitions in hand, you’ll be better equipped to navigate the DeFi landscape. In the next sections, we’ll explore how these concepts come together to form a functional, decentralized financial ecosystem.

3. How DeFi Works

Building upon our understanding of DeFi’s foundational principles, this section delves into the mechanics of DeFi, highlighting its unique features and comparing them to traditional financial systems.

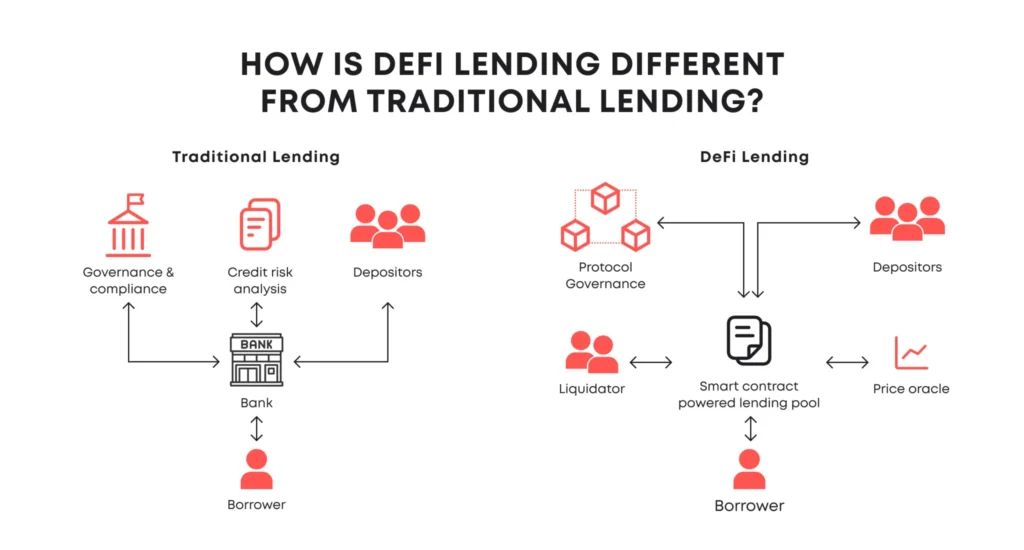

3.1 Traditional Finance vs. DeFi

The table below illustrates key differences between traditional finance and DeFi:

| Feature | Traditional Finance | Decentralized Finance (DeFi) |

|---|---|---|

| Accessibility | Limited by geography, banking hours, and regulatory requirements | Accessible globally 24/7 with an internet connection |

| Intermediaries | Requires banks, brokers, and other middlemen | Eliminates intermediaries through smart contracts |

| Control | Financial institutions have control over user funds | Users retain full control over their assets |

| Transparency | Operations are often opaque; users must trust institutions | Transactions are transparent and verifiable on the blockchain |

| Fees | Often involves various fees charged by intermediaries | Generally lower fees due to the absence of middlemen |

| Innovation Speed | Slower due to regulatory constraints and legacy systems | Rapid innovation with new financial products and services emerging frequently |

This comparison underscores the transformative potential of DeFi in creating a more inclusive and efficient financial system.

Why Does This Matter?

DeFi removes inefficiencies—such as gatekeeping, high fees, and opaque processes—giving you direct and transparent access to financial tools. In this world, code replaces the bank, and your crypto wallet becomes your personal gateway to saving, lending, borrowing, and more.

3.2 Core Components of DeFi

3.2.1 Smart Contracts

- Definition: Self-executing code on a blockchain that enforces rules automatically once conditions are met.

- Role in DeFi: Replace intermediaries (e.g., bankers, lawyers) by handling functions like lending, trading, and yield distribution.

- Key Benefit: Reduced costs and friction—transactions settle instantly, 24/7, without waiting for human approval.

Example:

- When you deposit crypto into a DeFi lending protocol like Aave or Compound, a smart contract automatically handles interest calculations and collateral requirements—no bank manager needed.

3.2.2 Oracles

- Definition: Services or mechanisms that feed off-chain data (like asset prices, real-world events) into a blockchain.

- Role in DeFi: Ensures protocols have accurate information for price feeds, interest rates, or synthetic asset valuation.

- Potential Risk: Oracle manipulation can lead to incorrect pricing and protocol exploits, which is why decentralized oracle solutions (e.g., Chainlink) are highly valued.

3.2.3 Stablecoins

- Definition: Cryptocurrencies designed to maintain a stable value, typically pegged to a fiat currency like USD.

- Role in DeFi: Provide a steady unit of account and reduce volatility, making lending, borrowing, and trading more predictable.

- Examples: DAI (decentralized, collateral-backed), USDC, USDT (centralized, fiat-backed).

Why Stablecoins Are Crucial:

They act like the “cash” of the crypto world, enabling DeFi users to park funds in a relatively stable asset without leaving the blockchain ecosystem.

3.2.4 Layer 2 Solutions

- Definition: Protocols built on top of a base blockchain (like Ethereum) to improve scalability and reduce fees.

- Examples: Arbitrum, Optimism, Base (Coinbase’s L2).

- How They Work: Process transactions off-chain (or in sidechains) before settling final data on the main blockchain.

- Why It Matters: Lower transaction costs and faster confirmation times make DeFi more accessible and user-friendly.

3.3 Key Innovations in DeFi

3.3.1 Automated Market Makers (AMMs)

- What They Are: Smart contracts that use liquidity pools instead of traditional buy/sell order books.

- Why They Matter: AMMs (like Uniswap) let anyone become a “market maker” by depositing tokens, earning trading fees in return.

3.3.2 Governance Tokens

- What They Are: Tokens that grant holders voting rights in protocol decisions.

- Examples: UNI (Uniswap), COMP (Compound), AAVE (Aave).

- Why They Matter: Users can shape the protocol’s future—everything from fee structures to new feature rollouts.

3.3.3 Composability

- What It Means: DeFi protocols are often described as “money Legos,” meaning they can integrate with each other seamlessly.

- Why It Matters: Users can stack or combine multiple DeFi services—e.g., deposit stablecoins on Aave, then use the interest-bearing token as collateral elsewhere—unlocking endless strategies and innovations.

3.4 Putting It All Together: An Example Workflow

Imagine you have 1 ETH and want to explore DeFi:

- Deposit ETH on a Lending Protocol – Earn interest and get a collateralized loan of stablecoins.

- Swap Stablecoins on a DEX – Trade those stablecoins for another crypto token, all within a smart contract environment.

- Provide Liquidity – Supply tokens to a liquidity pool on Uniswap to earn trading fees.

- Stake LP Tokens – Take the liquidity provider (LP) tokens you receive and stake them in a farming protocol to earn additional rewards.

All these actions happen without a bank or broker—just you, your wallet, and smart contracts ensuring everything runs smoothly.

3.5 Why Understanding the Mechanics Is Crucial

- Risk & Reward: High yields can be tempting, but not all protocols are created equal. Knowing how DeFi works under the hood helps you spot red flags and evaluate real vs. inflated opportunities.

- Empowerment: By cutting out middlemen, DeFi gives you full financial control—but also full responsibility for securing funds and managing risks.

- Future-Proof Skills: As DeFi evolves, foundational knowledge on smart contracts, oracles, and Layer 2 solutions will remain relevant—if not essential—for navigating new platforms.

Key Takeaways for Section 3:

- DeFi vs. TradFi: DeFi is global, open-access, and transparent—removing intermediaries via smart contracts.

- Building Blocks: Smart contracts, oracles, stablecoins, and Layer 2 solutions form the backbone of the DeFi ecosystem.

- Innovation & Composability: Protocols integrate like “money Legos,” enabling creative strategies but also compounding risk.

- Next Step: With this understanding, you’re better prepared to explore the practical side of DeFi, from wallets and swapping tokens to lending, borrowing, and beyond.

With a solid grasp of these building blocks, you can now move on to Section 4, which will guide you through getting started safely—covering everything from wallet setup to conducting your first DeFi transaction.

4. Getting Started Safely

Now that you understand what DeFi is and how it works, it’s time to dive in. But just like learning to swim, you’ll want to start in the shallow end before venturing into the deep. This section walks you through the essential steps to begin your DeFi journey safely—from choosing a wallet and funding it to executing your very first transactions.

4.1 Set Up a Wallet

Your crypto wallet is your passport to the DeFi ecosystem. It’s where you’ll store your funds, sign transactions, and interact with decentralized applications (dApps). Choose one that balances convenience and security.

4.1.1 Types of Wallets

- Hot Wallets (Software Wallets)

- MetaMask (Browser Extension):

- Popular for its simplicity and compatibility with most DeFi dApps.

- Easy to install on Chrome, Firefox, or Brave.

- Tip: Always verify you’re downloading the official extension from the correct source.

- Trust Wallet (Mobile App):

- Great for on-the-go users, supports multiple blockchains.

- Owned by Binance but remains relatively open.

- Pros: Quick setup, user-friendly.

- Cons: Connected to the internet, higher risk of phishing or malware attacks.

- MetaMask (Browser Extension):

- Hardware Wallets (Cold Wallets)

- Examples: Ledger, Trezor.

- Pros: Private keys are stored offline, offering maximum security.

- Cons: Costs money, slightly more complex to integrate with DeFi platforms (you’ll typically still connect via MetaMask or another interface).

Security Tip: Whether you use a hot wallet or a hardware wallet, never share your seed phrase (also called a recovery phrase). Treat it like the password to your entire bank account—because, effectively, it is.

4.2 Buy & Transfer Crypto

To interact with most DeFi protocols, you’ll need ETH (for gas fees on Ethereum) or stablecoins like USDC or DAI. Here’s how to get started:

- Choose a Centralized Exchange (CEX)

- Examples: Coinbase, Binance, Kraken.

- Use fiat (USD, EUR, etc.) to buy ETH or stablecoins.

- Transfer Crypto to Your Wallet

- Go to the “Withdraw” or “Send” section on your exchange.

- Paste your wallet address (double-check to avoid typos).

- Include a little extra ETH in your wallet to cover gas fees for DeFi transactions.

- Confirm the Network

- If you’re on Ethereum, be sure to select “ERC-20” for stablecoins.

- If you plan to use a Layer 2 network (like Arbitrum or Optimism), you may need to bridge your assets. We’ll cover that shortly.

Pro Tip: When sending crypto for the first time, try a small test transaction to make sure you’ve got the correct address and network.

4.3 Start Small & Experiment

DeFi is exciting but also comes with risks—hacks, scams, and volatile markets. Protect yourself by starting with small amounts:

- Swap a Small Amount on a DEX

- Example: Use Uniswap to swap a tiny portion of ETH for a stablecoin.

- Observe how gas fees and transaction confirmations work.

- Lend on a Trusted Protocol

- Example: Deposit a small amount into Aave to earn interest.

- Explore the dashboard, see how APYs vary, and learn how to withdraw funds.

- Join DeFi Communities

- Discord & Telegram: Most major DeFi protocols have active channels.

- Twitter: Follow reputable DeFi influencers and developers.

- Stay updated on potential scams, smart contract upgrades, or governance votes that might affect your investments.

4.4 Bridging to Layer 2 (Optional but Recommended)

Ethereum gas fees can be high during peak times. Many DeFi users save on fees by moving funds to a Layer 2 (L2) solution or sidechain:

- Choose an L2 or Sidechain

- Examples: Arbitrum, Optimism, Base, Polygon.

- Each has its own pros (lower fees, faster transactions) and cons (varying levels of decentralization).

- Use Official Bridges

- Visit the official bridge (e.g., bridge.arbitrum.io, optimism.io/bridge).

- Connect your wallet, specify the amount and token you want to bridge.

- Explore L2 DeFi

- Many popular protocols (Uniswap, Aave, Curve) have L2 versions.

- Interact the same way you do on Ethereum, but enjoy cheaper and faster transactions.

Bridge Caution: Always verify you’re on the official URL. Phishing sites often mimic popular bridges to steal user funds.

4.5 Red Flags & Security Best Practices

- Phishing Scams

- Lookalike URLs: Scammers replicate websites with slight domain name changes.

- Solution: Bookmark official sites or type URLs manually.

- Fake Airdrops & Giveaways

- “Send 0.1 ETH to get 1 ETH back” is a classic scam.

- No legitimate DeFi project demands you send funds to receive a reward.

- Rug Pull Risks

- Projects offering extremely high APYs may be unsustainable or outright fraudulent.

- Do Your Research: Check audits, team credentials, and community sentiment.

- Smart Contract Audits

- Reputable protocols usually publish audit reports from firms like ConsenSys Diligence, Quantstamp, or CertiK.

- Audits aren’t foolproof but do reduce the likelihood of hidden exploits.

- Use a Hardware Wallet for Large Sums

- Once your portfolio grows, a hardware wallet adds an extra layer of protection.

- Even if your PC or browser is compromised, hackers can’t move funds without pressing buttons on the physical device.

Key Takeaways for Section 4

- Wallet Choice: Hot wallets are user-friendly for daily DeFi activities; hardware wallets are ideal for holding larger amounts.

- Initial Funding: Buy ETH or stablecoins on a reputable exchange and transfer them carefully.

- Small Steps First: Minimize risk by testing small amounts until you’re comfortable with transactions and fees.

- Stay Vigilant: Verify URLs, avoid suspicious schemes, and learn to spot potential scams.

- Bridging Benefits: Layer 2 solutions can drastically lower transaction costs if you’re comfortable bridging assets.

With your wallet set up, initial crypto in hand, and these security precautions in mind, you’re ready to explore the core DeFi applications in the next section. Let’s dive into decentralized exchanges, lending platforms, yield farming opportunities, and more—where you’ll discover just how powerful this new financial frontier can be.

5. Essential DeFi Applications

You’ve set up your wallet, funded it with crypto, and now you’re ready to explore. Where should you start? In this section, we’ll walk through the core DeFi applications that are reshaping traditional finance—from trustless exchanges to decentralized lending protocols and yield-generating strategies. These platforms are the bedrock of the DeFi ecosystem.

5.1 Decentralized Exchanges (DEXs) – The New Age Trading Posts

Function: DEXs allow you to trade cryptocurrencies directly from your self-custody wallet, cutting out intermediaries like centralized exchanges.

- How It Works

- Liquidity Pools: Unlike traditional exchanges with order books, DEXs (e.g., Uniswap, SushiSwap) use pools of tokens provided by other users.

- Automated Market Makers (AMMs): Smart contracts automatically execute trades against these pools using mathematical formulas.

- Win-Win: Liquidity providers earn a slice of trading fees, while traders enjoy a permissionless, trustless experience.

- Top DEXs

- Uniswap: The OG of Ethereum-based DEXs, known for its simple interface and large liquidity.

- SushiSwap: A Uniswap spin-off that adds extra perks like yield farming rewards.

- PancakeSwap (BSC): Popular on the Binance Smart Chain, offering lower fees.

- Pros & Cons

- Pros:

- No KYC or sign-up required.

- Self-custody (you hold your private keys).

- Potentially lower fees compared to many centralized platforms.

- Cons:

- Slippage and impermanent loss for liquidity providers.

- Relying on on-chain transactions can result in higher gas fees (on Ethereum mainnet).

- Pros:

Key Takeaway: DEXs democratize trading by removing gatekeepers, letting anyone with a wallet swap tokens at any time.

5.2 Lending & Borrowing – Be Your Own Bank

Function: Platforms where you can lend your crypto to earn interest or borrow against your holdings. This eliminates the need for traditional banks or credit checks.

- How It Works

- Lending Pools: You deposit your assets into a smart contract pool.

- Collateralized Borrowing: Borrowers must deposit collateral (often 150% or more of the loan’s value) to secure a loan.

- Dynamic Interest Rates: Interest rates adjust automatically based on supply and demand in real time.

- Top Platforms

- Aave: Known for flash loans and diverse collateral options.

- Compound: One of the earliest lending protocols, focuses on simplicity.

- MakerDAO: Enables you to generate DAI (a decentralized stablecoin) by locking up collateral like ETH.

- Pros & Cons

- Pros:

- Earn passive income simply by holding assets in a lending pool.

- Borrowers retain exposure to their crypto (no need to sell it).

- Cons:

- Over-collateralization can be capital-inefficient if you need a large loan.

- Sudden price swings can trigger liquidations if collateral value drops too low.

- Pros:

Key Takeaway: By removing traditional credit checks and banking hours, DeFi lending protocols enable a global, permissionless lending market that operates around the clock.

5.3 Yield Farming & Staking – Put Your Crypto to Work

Function: Maximize returns on your idle crypto by providing liquidity, staking tokens, or participating in protocol incentives. Think of it like earning interest or dividends, but in a decentralized way.

5.3.1 Yield Farming

- Definition

- Providing liquidity to a protocol in exchange for rewards, often in the form of additional tokens (e.g., governance tokens).

- How It Works

- Liquidity Provider (LP) Tokens: When you deposit funds into a DEX liquidity pool, you receive LP tokens representing your share of that pool.

- Staking LP Tokens: Some platforms (e.g., SushiSwap, Curve, Balancer) allow you to stake those LP tokens to earn extra yield.

- Compound Rewards: In some cases, you can even stake the reward tokens to earn more rewards—creating a compounding effect.

- Risks:

- Impermanent Loss: If the price of the tokens in your pool shifts significantly, you may end up with fewer of the more valuable token.

- Smart Contract Vulnerabilities: Always check audits and the protocol’s reputation.

Example:

Deposit USDC and ETH into a Uniswap pool, earn trading fees plus extra UNI tokens, and then stake those UNI on another platform for even more rewards.

5.3.2 Staking

Locking up tokens to secure a Proof-of-Stake (PoS) blockchain or participating in governance and earning staking rewards in return.

In simple terms:

- You lock up your tokens to participate in the network.

- You earn rewards for doing so (kind of like interest on a savings account).

- The more you stake, the bigger your rewards.

Why does staking exist? Instead of using energy-intensive mining like Bitcoin, PoS blockchains use staking to secure the network in a more efficient and eco-friendly way.

5.4 Types of Staking

There’s more than one way to stake crypto—and choosing the right method depends on your goals, risk tolerance, and technical know-how.

5.4.1 Direct Staking (Validator & Delegator Staking)

🔹 Best for: Long-term holders who want full control over their assets.

There are two main ways to stake directly on a blockchain:

- Become a Validator: You run a node, validate transactions, and earn staking rewards. Requires technical knowledge & high minimum deposits (e.g., 32 ETH for Ethereum).

- Be a Delegator: You delegate your tokens to an existing validator, sharing in their rewards. No technical skills required.

🔹 Examples:

- Ethereum (ETH 2.0) – Stake 32 ETH to become a validator.

- Solana (SOL) – Delegate SOL to a validator for staking rewards.

Risks of Direct Staking:

- Lock-up periods: Some networks require you to keep tokens staked for weeks or months.

- Slashing penalties: If a validator misbehaves, part of the stake can be slashed (lost).

5.4.2 Liquid Staking – Staking Without Losing Liquidity

Best for: DeFi users who want to keep earning while using their assets elsewhere.

The biggest downside of traditional staking? Your tokens are locked up—meaning you can’t use them elsewhere in DeFi. That’s where liquid staking comes in.

How It Works:

- You stake your tokens through a liquid staking platform.

- In return, you get a staking derivative token (e.g., stETH for Ethereum).

- You can use this new token in DeFi to lend, provide liquidity, or yield farm—all while still earning staking rewards.

Examples of Liquid Staking:

- Lido – Stake ETH and get stETH, which can be used in DeFi.

- Rocket Pool – Decentralized ETH staking with liquid staking options.

- Frax ETH (frxETH) – Offers liquid staking rewards with additional DeFi integrations.

Pros of Liquid Staking:

- No lock-up periods – Your funds remain accessible.

- Double earning potential – Use your staked tokens in DeFi while earning staking rewards.

Risks of Liquid Staking:

- Smart contract risks – If a protocol gets hacked, your staked assets could be compromised.

- Value fluctuations – Some liquid staking tokens (like stETH) can trade below 1:1 parity with the original asset.

5.4.3 Centralized Exchange (CEX) Staking – The Easiest Way to Stake

🔹 Best for: Beginners who want a simple, hassle-free staking experience.

If you don’t want to deal with validators, wallets, or DeFi apps, centralized exchanges (CEXs) like Binance, Kraken, and Coinbase let you stake your crypto with a few clicks.

🔹 Examples of CEX Staking:

- Binance Staking – Supports ETH, SOL, DOT, and dozens of other tokens.

- Kraken Staking – Easy staking options with no lock-ups on some assets.

- Coinbase Staking – Simplified ETH staking for U.S. users.

Pros of CEX Staking:

- Super easy to use – Just deposit your tokens and earn rewards.

- No technical setup – No need to manage validators or smart contracts.

Risks of CEX Staking:

- You don’t control your funds – The exchange holds custody of your assets (like a bank).

- Regulatory risk – Some governments are cracking down on exchange staking programs (e.g., SEC vs. Kraken).

5.5 How Much Can You Earn from Staking?

Average Staking APYs:

| Crypto Asset | Typical APY | Notes |

|---|---|---|

| Ethereum (ETH 2.0) | 4-5% | Liquid staking via Lido or Rocket Pool available. |

| Solana (SOL) | 6-8% | Requires delegation to a validator. |

| Moonwell (WELL) | 6-8% | Staking available via Moonwell.fi |

| Cosmos (ATOM) | 18-20% | Staking rewards vary based on network activity. |

| Polygon (MATIC) | 6-12% | Staking available via exchanges or DeFi. |

Factors That Affect Staking Rewards:

- Network inflation – Some blockchains adjust rewards based on demand.

- Validator performance – Poor validators may miss rewards or get slashed.

- Lock-up periods – Some networks offer higher APYs for longer commitments.

5.6 Staking Risks & How to Stay Safe

Staking is less risky than yield farming, but it’s not completely risk-free.

Slashing Risks – If a validator behaves maliciously or goes offline, some of the staked funds can be slashed (lost). Fix: Choose high-reputation validators.

Lock-up Periods – Some assets (like DOT or ETH) require weeks/months before you can withdraw. Fix: Use liquid staking options for flexibility.

Smart Contract Risks – If using liquid staking, protocols can be hacked (like what happened with Lido clones). Fix: Stick to well-audited platforms.

Exchange Risk (for CEX Staking) – Not your keys, not your crypto. If an exchange gets hacked or shuts down staking, your funds could be frozen.

Best Practices for Safe Staking:

- Diversify staking across multiple validators or platforms.

- Use liquid staking only if you need access to your funds.

- Research validators—don’t just pick the highest APY.

- Withdraw staking rewards regularly to reduce risk exposure.

5.7 Other Notable DeFi Applications (Brief Overviews)

While DEXs, lending, and yield farming/staking form the core of DeFi, you’ll also encounter:

- Stablecoins & Payments: Stablecoins like DAI and USDC facilitate everyday transactions within DeFi. Some projects aim to offer global payment rails with near-instant transfers.

- Asset Management & Aggregators: Tools like Yearn Finance, Zapper, and DeBank help you find the best yields, track your portfolio, and automate complex DeFi strategies.

- Insurance Protocols: Platforms like Nexus Mutual or InsurAce offer coverage against smart contract hacks or stablecoin depegging.

- Derivatives & Synthetics: Protocols like Synthetix let you trade synthetic assets (e.g., synthetic USD, stocks, commodities) all on-chain. (We’ll dive deeper into these in the Advanced Concepts section.)

Key Takeaways for Section 5

- DEXs: A trustless way to trade tokens using liquidity pools instead of middlemen.

- Lending & Borrowing: Be your own bank—lend for passive income or borrow against your crypto.

- Yield Farming & Staking: Powerful strategies to earn additional rewards on top of regular appreciation, but be mindful of risks.

- Beyond the Basics: Stablecoins, insurance, derivatives, and aggregators round out a diverse, rapidly innovating DeFi ecosystem.

Up next, we’ll look at Security & Risk Management, where you’ll learn how to protect yourself from common DeFi pitfalls—like impermanent loss, rug pulls, and oracle manipulation—while maintaining a healthy, diversified portfolio.

6. Security & Risk Management

DeFi can offer incredible opportunities for yields, but it also comes with unique risks. Hacks, market volatility, smart contract bugs, and social engineering scams are part of this still-maturing ecosystem. In this section, you’ll learn how to protect yourself from common pitfalls and manage a healthy, balanced portfolio. for a deeper dive on security, visit our guide on safeguarding your assets.

6.1 Common DeFi Risks & How to Avoid Them

The table below summarizes some of the most frequent risks encountered in decentralized finance, along with key strategies to mitigate them.

| Risk Type | Description | Mitigation Strategies |

|---|---|---|

| Smart Contract Bugs | Flaws in the protocol’s code can be exploited, potentially leading to significant fund losses. | – Use reputable, audited platforms (look for well-known auditors like Quantstamp or ConsenSys Diligence). – Keep an eye on community discussions. |

| Impermanent Loss | Occurs when providing liquidity to pairs with volatile tokens, causing a temporary loss vs. holding. | – Understand the concept thoroughly before depositing. – Consider stablecoin pairs to minimize volatility. |

| Phishing & Scams | Fake websites, social media scams, or impersonators tricking you into sharing private info or funds. | – Always double-check URLs and only use official links. – Never share your seed phrase or private keys. – Consider hardware wallets. |

| Market Volatility | Crypto prices can swing wildly, affecting both borrowing collateral and token valuations. | – Only invest what you can afford to lose. – Maintain healthy collateral ratios if borrowing. – Keep stablecoins on hand as a hedge. |

| Rug Pulls | Developers abandon or run off with user funds after inflating a token’s value or liquidity pool. | – Research project teams, read audits, and check community sentiment. – Be wary of platforms offering unrealistically high APYs. |

| Oracle Manipulation | Incorrect price feeds can lead to unexpected liquidations or exploit opportunities for attackers. | – Stick to protocols that use decentralized or trusted oracles (e.g., Chainlink). – Diversify across multiple protocols if possible. |

| Regulatory Uncertainty | DeFi regulations are still evolving; platforms may face legal actions or forced shutdowns. | – Stay updated on local laws and regulatory news. – Use reputable projects that engage with compliance and risk frameworks. |

Remember: While no strategy can guarantee zero risk, being proactive and informed can significantly reduce your chances of falling victim to exploits or scams.

6.2 Portfolio Risk Management

Risk management is as important in DeFi as it is in any other investment arena. The strategies below help you balance growth with safety.

6.2.1 Diversification

- Don’t Put All Your Eggs in One Basket

- Spread your funds across different DeFi protocols and blockchains (e.g., Ethereum, Arbitrum, Polygon).

- Use a mix of asset types: stablecoins, blue-chip DeFi tokens (like ETH, AAVE), and a smaller share in speculative altcoins.

- Varying Yield Strategies

- If you’re yield farming on one platform, consider staking or lending on another.

- This way, if one protocol faces an exploit, not all of your capital is at risk.

6.2.2 Regular Monitoring

- Check on Your Positions: Even “passive” DeFi strategies (lending, staking) can be affected by sudden market changes or contract updates.

- Use Dashboard Tools: Platforms like Zapper, DeBank, and Zerion let you track your entire DeFi portfolio across multiple networks in one place.

6.2.3 Rebalancing

- Set Targets & Rebalance Periodically: If you planned for 50% stablecoins and they now only make up 30% due to a token’s price surge, consider taking profits and rebalancing to maintain your desired risk level.

- Stay Objective: Emotions can run high during bull and bear markets, so set rules for rebalancing (e.g., monthly or quarterly) and stick to them.

6.3 DeFi Insurance & Additional Safeguards

6.3.1 DeFi Insurance Protocols

- Nexus Mutual

- Provides coverage against smart contract failures and exchange hacks.

- Operates as a mutual, so community members stake capital to underwrite policies.

- InsurAce

- Offers a multi-chain insurance marketplace for various DeFi protocols.

- Allows you to bundle different coverages in a single policy.

Pro Tip: Always read the terms & conditions carefully. Some insurance covers only specific contract exploits, not user errors or market volatility.

6.3.2 Multi-Sig Wallets

- What They Are: Wallets that require multiple private keys (e.g., 2-of-3 signers) to confirm transactions.

- Why It Helps: Reduces the risk of a single compromised key emptying all your funds. Commonly used by DAOs and teams, but also an option for personal security if you have trusted co-signers.

6.4 Simple Portfolio Allocation Example

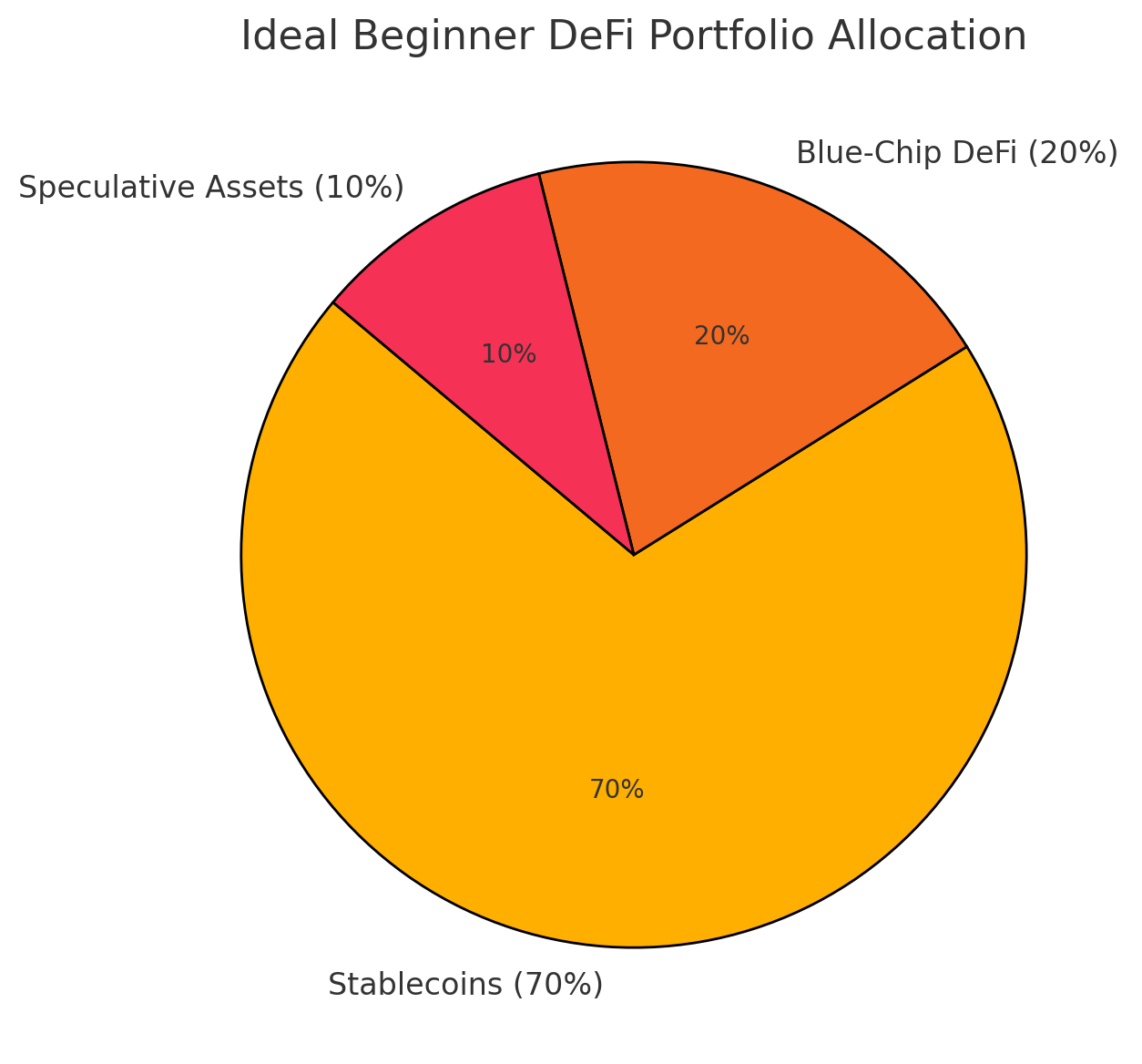

For beginners, consider a balanced approach that safeguards your capital while exposing you to DeFi’s growth potential:

- 70% Stablecoins (Safety Net)

- Earn interest in lending protocols (Aave, Compound) or stablecoin farms (Curve).

- Minimizes volatility and protects against major market swings.

- 20% Blue-Chip DeFi Tokens (Growth)

- ETH, AAVE, UNI, MKR—well-established with strong fundamentals.

- Optionally stake or lend these to earn additional yield.

- 10% Speculative Tokens (High Risk, High Reward)

- New or lesser-known projects offering high APYs.

- Keep this portion small to limit potential losses.

Rebalance every month or quarter to maintain these percentages. If speculative tokens skyrocket, consider selling some to reinforce your stablecoin “safety net.”

6.5 Best Practices Checklist

- Audit Awareness: Favor protocols with completed audits and active community reviews.

- Use Reputable Front-Ends: Phishing sites often mimic well-known dApps—bookmark official URLs.

- Stay Informed: Follow DeFi news outlets, protocol announcements, and developer updates.

- Double-Check Transactions: Always confirm token addresses and network details before approving a transaction.

- Limit Single-Protocol Exposure: Even “safe” protocols can be exploited; diversify to mitigate total loss.

Key Takeaways for Section 6

- Risk Is Inherent: While DeFi opens a world of financial freedom and innovation, it also carries significant risks—from contract exploits to extreme market volatility.

- Mitigation Strategies: Diversification, audits, insurance, and using reputable platforms are critical steps toward safeguarding your assets.

- Portfolio Balance: Consider a mix of stablecoins, blue-chip DeFi tokens, and a small share in higher-risk projects to spread out exposure.

- Stay Vigilant: Constantly monitor your holdings, keep up with protocol developments, and regularly reassess your risk tolerance.

Armed with these security and risk management strategies, you’re better positioned to navigate DeFi safely. Next, we’ll explore Advanced DeFi Concepts—like Layer 2 scaling, governance tokens, and innovative yield strategies—so you can further optimize your DeFi experience.

7. Advanced DeFi Concepts

You’ve got the basics—now let’s level up. DeFi is constantly evolving, and if you want to maximize your returns (and minimize your risks), you need to understand the advanced tools and strategies shaping the space.

7.1 Layer 2 Scaling – Faster, Cheaper Transactions

Ethereum is great, but it’s also slow and expensive. Layer 2 solutions fix that.

Ethereum’s popularity comes with a big downside—high fees (gas costs) and slow transaction times. Layer 2 solutions are designed to solve this problem by processing transactions off-chain before settling them back on Ethereum, reducing congestion and cutting fees dramatically.

Popular Layer 2 Solutions

| Network | Pros | Cons |

|---|---|---|

| Network | Pros | Cons |

| Ethereum | Most secure, most DeFi adoption | High gas fees |

| Arbitrum | Lower fees, inherits Ethereum security | Still developing |

| Optimism | Fast, cheap transactions | Less decentralized |

| Base | Coinbase-backed, growing ecosystem | Still new |

Why This Matters:

If you want to save money on transactions, using Layer 2 is a no-brainer. Platforms like Uniswap, Aave, and Sushiswap already support Layer 2 chains, meaning you can swap, lend, and farm yields with a fraction of the cost.

Pro Tip: Always use official bridges (e.g., bridge.arbitrum.io) to move assets between Ethereum and an L2. Double-check URLs to avoid phishing scams.

7.2 Governance & DAOs – Community-Driven Protocols

- What Are DAOs?

- Decentralized Autonomous Organizations govern DeFi protocols without traditional corporate hierarchies.

- Token holders vote on proposals—anything from adjusting fees to launching new products.

- Governance Tokens

- Examples: UNI (Uniswap), AAVE, COMP (Compound).

- Grant holders voting rights and sometimes a share in protocol revenues.

- The more tokens you own, the greater your influence on protocol decisions.

- Why It Matters:

- Decentralized governance can be more transparent and inclusive than corporate boards.

- Active governance communities often shape the protocol’s evolution, fostering innovation and accountability.

Real-World Example:

Uniswap token holders voted on a proposal to deploy Uniswap V3 to additional networks (e.g., Arbitrum). If you held UNI, you could voice your opinion and help direct Uniswap’s expansion.

7.3 Derivatives & Synthetics – Expanding Financial Products

Derivatives in DeFi open the door to more sophisticated trading strategies—similar to futures and options in traditional finance.

- Synthetix

- Enables the creation of synthetic assets that track real-world prices (e.g., sUSD, sBTC, stocks, commodities).

- Users gain exposure to these assets without holding them directly.

- Decentralized Options & Futures

- Protocols like Dopex, Lyra, or dYdX offer on-chain options/futures.

- Traders can hedge risk or speculate on asset price movements.

- Risks:

- Leverage & Liquidations: Highly leveraged positions can be liquidated quickly if the market moves against you.

- Oracle Reliability: Accurate price feeds are crucial; a faulty oracle can lead to unexpected losses.

Key Takeaway: Derivatives allow sophisticated hedging and speculation, but they also carry complex risk. Start small or thoroughly research before diving in.

7.4 NFTs in DeFi – Beyond Collectibles

Non-Fungible Tokens (NFTs) aren’t just for digital art. They’re also finding utility in DeFi.

- NFT Lending & Borrowing

- Platforms like NFTfi or BendDAO let you use NFTs as collateral for crypto loans.

- Values are determined by floor price, rarity, and market demand.

- Fractionalized NFTs

- Services like Fractional.art allow you to split an NFT into multiple ERC-20 tokens, enabling shared ownership.

- Lower entry cost for expensive NFTs and more liquidity in the market.

- NFT Staking & “Renting”

- Some games and metaverse platforms let NFT owners stake or rent out their digital assets (e.g., land plots, in-game items) for passive income.

Why It Matters: Integrating NFTs into DeFi fosters new use cases (like tokenized real estate, game assets) and increases liquidity for previously illiquid assets.

7.5 Cross-Chain Interoperability – The Multi-Chain Future

Cross-chain solutions and bridges allow assets and data to move between different blockchain networks, expanding DeFi’s reach.

- Why It’s Needed:

- Users want to tap into DeFi on multiple chains (e.g., Ethereum, BNB Chain, Polygon) without separate wallets and funds.

- Different chains often specialize in unique use cases (low fees, high speed, specialized dApps).

- Popular Cross-Chain Bridges

- Wormhole: Connects Solana, Ethereum, Terra, and more.

- Hop Protocol: Focuses on quick transfers between L2s and Ethereum mainnet.

- Cautions:

- Bridges have been a common target for hackers (e.g., cross-chain exploits).

- Ensure the bridge is audited and has a track record of secure operations.

Future Outlook: As more chains emerge, true interoperability could enable a “multi-chain metaverse,” where users seamlessly move assets and liquidity across different networks.

7.6 Exploring Beyond the Basics

- Flash Loans

- Instant loans that must be repaid within the same transaction block.

- Used for arbitrage, debt refinancing, or complex on-chain trades.

- High risk if you don’t fully understand smart contract interactions.

- Algorithmic Stablecoins

- Attempt to maintain a peg (usually 1:1 to USD) using software algorithms instead of full collateral.

- Examples: UST (historical cautionary tale), FRAX (partially algorithmic).

- Volatile and risky if the peg mechanism fails.

- Composability (“Money Legos”)

- DeFi protocols are designed to be interoperable. You can deposit a token into one protocol, use the tokenized receipt in another, and chain multiple yields together.

- While powerful, it also means a hack in one protocol can have a domino effect on others relying on it.

Key Takeaways for Section 7

- Layer 2 Scaling: Lower fees and faster transactions open DeFi to broader participation.

- DAO Governance: Community-driven protocols give users direct influence over platform decisions.

- Derivatives & Synthetics: Offer advanced financial instruments but come with increased complexity and risk.

- NFTs in DeFi: Move beyond collectibles to use cases like lending, staking, and fractional ownership.

- Cross-Chain Future: Bridges and interoperability expand DeFi’s global reach while adding new security considerations.

- Stay Informed: Advanced DeFi often moves quickly; deep research is essential before diving into new protocols or strategies.

With these advanced DeFi concepts in mind, you’re well on your way to exploring the cutting edge of decentralized finance. In the next section, we’ll discuss practical “Next Steps”—including learning resources, community engagement, and how to keep evolving alongside this rapidly changing ecosystem.

8. Next Steps

You’ve gained a comprehensive overview of Decentralized Finance—from the basics of how it works and how to get started, to advanced concepts like Layer 2 scaling and derivatives. Now, it’s time to take action and continue your journey with a plan for ongoing learning, experimentation, and community involvement.

8.1 Engage with DeFi Platforms

- Explore Multiple Protocols

- Try Out Different DEXs: Compare the user experience and fees on Uniswap, SushiSwap, PancakeSwap, or Curve.

- Experiment with Layer 2: Move some funds to Arbitrum or Optimism and notice how faster, cheaper transactions can change your trading and farming strategies.

- Participate in Governance

- Hold Governance Tokens: Buy a small amount of UNI, AAVE, or COMP and see how voting proposals work.

- Join DAO Discussions: Many protocols have forums (e.g., Snapshot, Discourse) where community members debate improvements and new features.

- Get Hands-On With dApps

- Lend & Borrow: Try depositing funds into Aave or Compound, borrow a small stablecoin loan, and repay it.

- Yield Farming & Staking: Stake your tokens on a platform like SushiSwap or Yearn Finance to see how yields fluctuate.

Pro Tip: Keep detailed notes on your experience—what fees you paid, what rewards you earned, and any challenges you faced. This will help you refine your strategies over time.

8.2 Stay Informed & Continue Learning

- Engage with DeFi Platforms:

- Participate in Community Events:

- Attend webinars, virtual meetups, and conferences to network with professionals and enthusiasts. Events like DeFi Summit offer valuable insights and learning opportunities.

- Stay Informed:

- Follow reputable DeFi news outlets and blogs to keep abreast of the latest developments, regulatory changes, and technological advancements.

- Practice Due Diligence:

- Before engaging with any DeFi project, research thoroughly. Review audits, understand the team behind the project, and assess the community’s feedback.

- Experiment and Reflect:

- Allocate a small portion of your portfolio to experiment with different DeFi protocols. Reflect on your experiences to identify areas for further study and improvement.

8.3 Community Engagement & Networking

- Discord & Telegram Communities

- Almost every DeFi protocol has its own Discord server or Telegram group. Join in to ask questions, share ideas, and stay informed about platform updates.

- Example communities: Aave Official Discord, Uniswap Discord, MakerDAO Rocket.Chat.

- Attend Virtual & Physical Events

- Hackathons (ETHGlobal, local ETH events): Even if you’re not a developer, you can learn a lot by observing or joining teams.

- Conferences (Devcon, ETHDenver, Token2049): Great for networking with founders, developers, and active community members.

- Meetups & Local Groups

- Check platforms like Meetup.com or social media for local crypto/DeFi meetups.

- In-person events can fast-track your understanding and connect you with potential collaborators or mentors.

Tip: Don’t be afraid to ask “basic” questions in these communities—DeFi is still new, and most enthusiasts are happy to help newcomers.

8.4 Practice Due Diligence & Self-Reflection

- Research Before You Invest

- Read whitepapers or lightpapers to understand a project’s value proposition.

- Check audit reports from reputable firms.

- Evaluate the team (experience, track record) and community sentiment.

- Reflect on Your Strategies

- What Worked & What Didn’t? Keep track of your wins and losses, noting which strategies performed well and which didn’t.

- Adjust Risk Tolerance: As you learn more, you might feel comfortable allocating more capital to certain protocols or trying newer (but riskier) projects.

- Long-Term Perspective

- DeFi is volatile and evolving. It’s easy to get caught up in short-term trends or hype.

- Focus on long-term value creation and technologies that solve real problems in finance.

8.5 Looking Ahead: The Future of DeFi

- Regulatory Shifts

- Governments worldwide are still defining their stance on DeFi. Keep an eye on policy changes that could affect market access and protocol compliance.

- Some projects may pivot or introduce KYC elements to comply with emerging laws.

- New Frontiers

- Real-World Asset (RWA) Tokenization: Assets like real estate, stocks, or commodities are increasingly being tokenized for DeFi use.

- Zero-Knowledge (ZK) Proofs: Technologies like ZK-Rollups could revolutionize privacy and scalability in DeFi.

- Cross-Chain Protocols: Expect more seamless interoperability as bridging solutions mature.

- Ecosystem Maturity

- As DeFi grows, we’ll see more user-friendly interfaces, better audits, insurance solutions, and mainstream adoption—making it an even more viable alternative to traditional finance.

Key Takeaways for Section 8

- Engage & Explore: Hands-on experience is invaluable. Try different protocols, networks, and strategies.

- Stay Informed: Follow reputable news outlets, attend events, and network with the community to keep pace with a rapidly evolving landscape.

- Do Your Own Research (DYOR): Always investigate a project’s team, audits, and tokenomics before investing.

- Think Long-Term: DeFi is still in its early stages. Focus on building a solid, well-researched portfolio and skill set for the future.

With these “Next Steps” in mind, you’re well-equipped to continue your DeFi journey. Whether you’re aiming to become a yield farming pro, a DAO governance expert, or simply stay informed, the world of decentralized finance offers endless opportunities—and you now have the roadmap to navigate them confidently.